Good points, but known to us metal junkies. Silver is going over 100/oz.. How high and how long will it take is the real question.

===

Large Fund Flows Will Cause Silver Spike

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/31_Fleckenstein_-_Large_Fund_Flows_Into_Silver_Will_Cause_Spike.html

With the US dollar weaker once again and gold and silver mixed, today King World News interviewed Bill Fleckenstein President of Fleckenstein Capital to get his take on where these markets are headed. When asked about recent turmoil in the silver market Fleckestein stated, “People have to recognize that silver is a much smaller market than gold, and as a consequence is more volatile. One of the reasons why some of the big numbers on the upside get tossed around is that if a lot of money decides it wants to own silver, given the size of the silver market, then it could trade at some big price.”

Fleckenstein continues:

“But the downside of a smaller market and a volatile market is that you can have moments in time where it hits a bit of a vacuum. I think that one needs to be prepared to see the price 10% lower at any moment in time if not 15% lower and have it not mean much because that’s just the nature of the beast.

===

z

intro

A place to bounce around ideas and information... in general just chit chat... Because we're all different, and yet, we are all the same, just like zebras.

Topics: Silver, Gold, Financial Markets, Commodity Markets, Politics, Global Geopolitical Eco-Finances, Globalists, New World Order, Freedom, Health, Agriculture & Crops, GMOs, etc...

Peace.

Tuesday, May 31, 2011

Food Stamps and Zynga Dollars

Plain to see, if you wanna look.

====

MaxKeiser.com

Food Stamps and Zynga Dollars

Not many Americans understand that the goal of the food stamp program is to expand it to include the entire ‘bottom 99%’ in America who will also be treated with millions of gaming coins (Zynga Dollars) as the official currency of the Casino-Gulag. Food stamps are not a temporary solution, they are part of the replacement process of the U.S. dollar (now fractionally backed by a claim on Wall St. bonuses) to having no claim whatsoever on Wall St. or Washington insiders (i.e., complete loss of political representation as part of the return to feudalism). The prison is being built around you. You will never officially be ‘sent’ to prison. The prison is coming to you. The monarchy will never officially be reestablished. It is being created from simultaneous elimination of the marginally fractional currency and marginally representative government and replacement with zero worth currency and zero representation.

===

z

====

MaxKeiser.com

Food Stamps and Zynga Dollars

Not many Americans understand that the goal of the food stamp program is to expand it to include the entire ‘bottom 99%’ in America who will also be treated with millions of gaming coins (Zynga Dollars) as the official currency of the Casino-Gulag. Food stamps are not a temporary solution, they are part of the replacement process of the U.S. dollar (now fractionally backed by a claim on Wall St. bonuses) to having no claim whatsoever on Wall St. or Washington insiders (i.e., complete loss of political representation as part of the return to feudalism). The prison is being built around you. You will never officially be ‘sent’ to prison. The prison is coming to you. The monarchy will never officially be reestablished. It is being created from simultaneous elimination of the marginally fractional currency and marginally representative government and replacement with zero worth currency and zero representation.

===

z

My new baby: 1858 .44

I decided to get into the old school black powder guns scene today. Got silver and gold? Might want to have a few guns too. Just saying. This is my new baby.

1858 New Army Stainless Steel .44 Caliber Target Revolver

z

1858 New Army Stainless Steel .44 Caliber Target Revolver

z

Saturday, May 28, 2011

Something Stirs in the Paper Metal Markets

I've always felt nervous about trading paper metals, in particular, silver. I've never felt bad about the phyzz in my hand.

I used to think that the paper markets would get to $100+ on silver before the 'dislocation' of the paper and physical markets. I'm not so sure anymore. I've had this feeing for a while and today again, I am strongly considering selling completely out of the markets and transferring those digits on my computer screen into physical gold, silver, and platinum bullion coins.

You have been warned. I will probably make this decision in the next couple of days. It will take 3 more to settle the stock sales, and then it will take another week to get the check, and cash it in a bank. Then it will take a few days for me to pick out my metals and transfer my bank dough to apmex and another week thereafter to get my phyzz.

This process will take 3 weeks. Plan ahead. If you feel like I do, time to make preparations. The shit is going to hit the fan. I think the paper and phyzz markets may 'dislocate' now before spot price of silver goes over $50.

Food for Thought. Happy Investing =)

z

I used to think that the paper markets would get to $100+ on silver before the 'dislocation' of the paper and physical markets. I'm not so sure anymore. I've had this feeing for a while and today again, I am strongly considering selling completely out of the markets and transferring those digits on my computer screen into physical gold, silver, and platinum bullion coins.

You have been warned. I will probably make this decision in the next couple of days. It will take 3 more to settle the stock sales, and then it will take another week to get the check, and cash it in a bank. Then it will take a few days for me to pick out my metals and transfer my bank dough to apmex and another week thereafter to get my phyzz.

This process will take 3 weeks. Plan ahead. If you feel like I do, time to make preparations. The shit is going to hit the fan. I think the paper and phyzz markets may 'dislocate' now before spot price of silver goes over $50.

Food for Thought. Happy Investing =)

z

Porter Stansberry's Credibility Debunked

We all know the now infamous video "end of america". Peter Schiff debunks Stansberry's claim that he knows what he is talking about.

This doesn't mean that the dollar won't collapse, it just means that Stansberry is less than credible. Read and learn, judge for yourself.

=====

Porter Stansberry's Credibility Debunked

=====

z

This doesn't mean that the dollar won't collapse, it just means that Stansberry is less than credible. Read and learn, judge for yourself.

=====

Porter Stansberry's Credibility Debunked

=====

z

Friday, May 27, 2011

Alex Jones Talks Texas Secession

The resent TSA scandal there with the lawmakers is ridiculous. I think other states are eying anti-TSA molestation bills too.

===

Alex Jones Talks Texas Secession

==

z

===

Alex Jones Talks Texas Secession

==

z

80% of unborn babies contaminated with GMO toxins, study finds

Just another sad facet of our current society.

====

80 percent of unborn babies contaminated with GMO toxins, study finds

http://www.naturalnews.com/032510_unborn_babies_GMOs.html

A landmark new study out of Canada exposes yet another lie propagated by the biotechnology industry, this time blowing a hole in the false claim that a certain genetic pesticide used in the cultivation of genetically-modified (GM) crops does not end up in the human body upon consumption. Researchers from the Department of Obstetrics and Gynecology at the University of Sherbrooke Hospital Centre in Quebec, Can., have proven that Bt toxin, which is used in GM corn and other crops, definitively makes its way into the blood supply, contrary to what Big Bio claims -- and this toxin was found in the bloodstreams of 93 percent of pregnant women tested.

Published in the journal Reproductive Toxicology, the study explains that Bt toxin enters the body not only through direct consumption of GMOs, but also from consumption of meat, milk and eggs from animals whose feed contains GMOs. Among all women tested, 80 percent of the pregnant group tested positive for Bt toxin in their babies' umbilical cords, and 69 percent of non-pregnant women tested positive for Bt toxin.

The only reason many countries even approved GM crops in the first place was because they were told that GM crops were no different than conventional crops. The biotechnology industry has purported for years that the alterations and chemicals used in GM crop cultivation pose no risk whatsoever to human health, and that any GM substances that remain in food are broken down in the digestive system. Now that it has been revealed that such claims are complete fabrications, many groups are urging governments to pull GMOs from their food supplies.

"This research is a major surprise as it shows that the Bt proteins have survived the human digestive system and passed into the blood supply -- something that regulators said could not happen," said Pete Riley from GM Freeze, an alliance of organizations united against GMOs. "Regulators need to urgently reassess their opinions, and the EU should use the safeguard clauses in the regulations to prevent any further GM Bt crops being cultivated or imported for animal feed or food until the potential health implications have been fully evaluated."

Most of the studies that have been used to validate the safety of GMOs have been conducted by the companies that created them in the first place, so they are hardly a credible source for reliable safety data. Governments in North and South America, as well as throughout Europe, have essentially welcomed GMOs into the food supply based on flimsy reassurances rather than sound science.

====

z

====

80 percent of unborn babies contaminated with GMO toxins, study finds

http://www.naturalnews.com/032510_unborn_babies_GMOs.html

A landmark new study out of Canada exposes yet another lie propagated by the biotechnology industry, this time blowing a hole in the false claim that a certain genetic pesticide used in the cultivation of genetically-modified (GM) crops does not end up in the human body upon consumption. Researchers from the Department of Obstetrics and Gynecology at the University of Sherbrooke Hospital Centre in Quebec, Can., have proven that Bt toxin, which is used in GM corn and other crops, definitively makes its way into the blood supply, contrary to what Big Bio claims -- and this toxin was found in the bloodstreams of 93 percent of pregnant women tested.

Published in the journal Reproductive Toxicology, the study explains that Bt toxin enters the body not only through direct consumption of GMOs, but also from consumption of meat, milk and eggs from animals whose feed contains GMOs. Among all women tested, 80 percent of the pregnant group tested positive for Bt toxin in their babies' umbilical cords, and 69 percent of non-pregnant women tested positive for Bt toxin.

The only reason many countries even approved GM crops in the first place was because they were told that GM crops were no different than conventional crops. The biotechnology industry has purported for years that the alterations and chemicals used in GM crop cultivation pose no risk whatsoever to human health, and that any GM substances that remain in food are broken down in the digestive system. Now that it has been revealed that such claims are complete fabrications, many groups are urging governments to pull GMOs from their food supplies.

"This research is a major surprise as it shows that the Bt proteins have survived the human digestive system and passed into the blood supply -- something that regulators said could not happen," said Pete Riley from GM Freeze, an alliance of organizations united against GMOs. "Regulators need to urgently reassess their opinions, and the EU should use the safeguard clauses in the regulations to prevent any further GM Bt crops being cultivated or imported for animal feed or food until the potential health implications have been fully evaluated."

Most of the studies that have been used to validate the safety of GMOs have been conducted by the companies that created them in the first place, so they are hardly a credible source for reliable safety data. Governments in North and South America, as well as throughout Europe, have essentially welcomed GMOs into the food supply based on flimsy reassurances rather than sound science.

====

z

Indiana attempts to take back 4th Amendment Rights

If you don't know what the 4th amendment is, I'll give you a hint... It protects unwarranted swat teams from breaking into your house and shooting you dead for no reason. Unwarranted search and seizure.

==

===

z

==

===

z

Ron Paul - "The Last Nail"

It's sad 'cause it's true. At our present speed we will be a police state dictatorship in about 4 or 5 more years if we don't turn course now. Time to wake up, get with the program, and vote for Ron Paul 2012.

====

===

z

====

===

z

Max Keiser’s Silver Liberation Army Gains A Recruit

Not only will you make money and protect yourself from the collapse of the USD, you will also help take down the banksters. Join the silver liberation army, buy physical silver.

===

Max Keiser’s Silver Liberation Army Gains A Recruit

===

z

===

Max Keiser’s Silver Liberation Army Gains A Recruit

===

z

Rob McEwen - Once $3,000 Falls Gold will Launch Like a Rocket

Buy now. Get some popcorn. Wait and watch. PM's will be epic in 1-2 years.

===

Rob McEwen - Once $3,000 Falls Gold will Launch Like a Rocket

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/27_Rob_McEwen_-_Once_$3,000_Falls_Gold_will_Launch_Like_a_Rocket.html

With the gold and silver markets still experiencing turbulence and the US dollar attempting to stabilize, today King World News interviewed one of the great company builders, Rob McEwen former CEO of Goldcorp and current Chairman & CEO of US Gold. When asked how he arrived at his gold target McEwen responded, “Looking at economic history and the cycles before, the $5,000 number is a fairly easy number to get to if you look at the last cycle where gold went from about $40 an ounce in 1970 to $800 in 1980. So, you had a twenty-fold move, and the low point for us recently was $250 back in 2001, and if you applied the same twenty-fold you arrive at $5,000.”

Rob McEwen continues:

“You have more people in the market today than you had in 1980. They are better connected by the internet and other communication means, and crowd psychology is going to play a bigger role. We’re seeing the paper currencies suffering a loss of confidence and people are looking for a place to go, and when we move from that 1% invested in gold, to 3 or 4 or 5%, the slope for the price of gold is going to be exponential and racing.”

The QE3 is going to happen and there will be a QE4 and probably a QE5. We’re looking at unprecedented amounts of monetary stimulation occurring not only on this side of the Atlantic, but over in Europe and it has been to stave off a collapse. There has been tremendous loss of value, but we haven’t seen a big jump in employment and we haven’t seen a large jump in capital investments and that’s what we need to see.

We need to more jobs created and this money isn’t doing that. So, that’s where you go back to the government saying, ‘well, we can’t stop right now because the job is not done.’ But for every one of your listeners, while this job is being done they have to go out and protect their assets against what’s happening.”

===

z

===

Rob McEwen - Once $3,000 Falls Gold will Launch Like a Rocket

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/27_Rob_McEwen_-_Once_$3,000_Falls_Gold_will_Launch_Like_a_Rocket.html

With the gold and silver markets still experiencing turbulence and the US dollar attempting to stabilize, today King World News interviewed one of the great company builders, Rob McEwen former CEO of Goldcorp and current Chairman & CEO of US Gold. When asked how he arrived at his gold target McEwen responded, “Looking at economic history and the cycles before, the $5,000 number is a fairly easy number to get to if you look at the last cycle where gold went from about $40 an ounce in 1970 to $800 in 1980. So, you had a twenty-fold move, and the low point for us recently was $250 back in 2001, and if you applied the same twenty-fold you arrive at $5,000.”

Rob McEwen continues:

“You have more people in the market today than you had in 1980. They are better connected by the internet and other communication means, and crowd psychology is going to play a bigger role. We’re seeing the paper currencies suffering a loss of confidence and people are looking for a place to go, and when we move from that 1% invested in gold, to 3 or 4 or 5%, the slope for the price of gold is going to be exponential and racing.”

The QE3 is going to happen and there will be a QE4 and probably a QE5. We’re looking at unprecedented amounts of monetary stimulation occurring not only on this side of the Atlantic, but over in Europe and it has been to stave off a collapse. There has been tremendous loss of value, but we haven’t seen a big jump in employment and we haven’t seen a large jump in capital investments and that’s what we need to see.

We need to more jobs created and this money isn’t doing that. So, that’s where you go back to the government saying, ‘well, we can’t stop right now because the job is not done.’ But for every one of your listeners, while this job is being done they have to go out and protect their assets against what’s happening.”

===

z

This is not 1980

This is from a precious metal blogger, in regards to the differences between now and 1980. Doubters, ignorant fools, and dollar shills, like to use 1980 as an example of why you should stay away from precious metals this time. This time, they are wrong.

---

This is not 1980. This is quite different.

Gold $855 1980, Silver intraday highest $55, Oil $37.Fed Funds Interest Rate 1979 11%.

Debt Aprox 1 trillion dollars.

The trade weighted US Dollar Index made a double bottom at $88.30 on 10/30/1978 and $92.24 on 7/10/1980 and hit a high of $148.12 on 2/25/1985 (St. Louis Fed Database)

CPI figures to 2011 Gold $2,333.77..Silver $150.12, Oil $100.99

Source-Gov BLS Calculator. *US Debt $14 Trillion. World population a lot higher.

In Dollars we can clearly SEE that Gold and Silver are under-valued assets except in the minds of the extremely ignorant of historic fact.

---

z

---

This is not 1980. This is quite different.

Gold $855 1980, Silver intraday highest $55, Oil $37.Fed Funds Interest Rate 1979 11%.

Debt Aprox 1 trillion dollars.

The trade weighted US Dollar Index made a double bottom at $88.30 on 10/30/1978 and $92.24 on 7/10/1980 and hit a high of $148.12 on 2/25/1985 (St. Louis Fed Database)

CPI figures to 2011 Gold $2,333.77..Silver $150.12, Oil $100.99

Source-Gov BLS Calculator. *US Debt $14 Trillion. World population a lot higher.

In Dollars we can clearly SEE that Gold and Silver are under-valued assets except in the minds of the extremely ignorant of historic fact.

---

z

Thursday, May 26, 2011

Bunker Hunt vs The Elite

Of course the difference is that the Hunt bros were corning the market long, while JPMorgue is corning the market short. So when the hunt bros were attacked the price collapse, whereas when the JPMorgue gets caught the market will explode upwards in price. It's the little man that is cornering the physical market this time around. Completely different. And interest rates can't go up, either.

===

Bunker Hunt vs The Elite

===

z

===

Bunker Hunt vs The Elite

===

z

Stephen Leeb - Silver Should Be $150 Today

I wish...

====

Stephen Leeb - Silver Should Be $150 Today

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/26_Stephen_Leeb_-_Silver_Should_Be_$150_Today.html

With so much volatility in the gold and silver markets, today King World News interviewed one of the top ranked money managers in the country, Dr. Stephen Leeb, Founder of Leeb Capital Management. Dr. Leeb’s comments surprised KWN in many ways, here is how he started the interview, “I think the United States has been asleep at the switch for a long time, and I think the Chinese in contrast have been wide awake to an emerging problem in the world and it’s one called resource scarcity. We’ve heard a lot about resource scarcity and mostly the reaction in the US is just to shrug their shoulders, we’ll figure out a way around it. Well, there really is not a way around certain kinds of scarcities.”

When asked where silver is headed in terms of price Leeb responded, “I could just look at it from a monetary point of view, forget about all of the industrial applications. The ratio of silver to gold in the world is about ten to one, maybe seven and a half to one, above and below ground if you look at reserves. So as a monetary metal you could make a case that silver should already be no more than a ten to one ratio with gold.”

When asked with the ten one ratio putting silver $150, is that an outrageous price for silver today Leeb responded, “No it isn’t, it’s not at all outrageous. Silver at $150 is in no way outrageous. I’m not counting the critical applications in the industrial and renewable areas.”

====

z

====

Stephen Leeb - Silver Should Be $150 Today

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/26_Stephen_Leeb_-_Silver_Should_Be_$150_Today.html

With so much volatility in the gold and silver markets, today King World News interviewed one of the top ranked money managers in the country, Dr. Stephen Leeb, Founder of Leeb Capital Management. Dr. Leeb’s comments surprised KWN in many ways, here is how he started the interview, “I think the United States has been asleep at the switch for a long time, and I think the Chinese in contrast have been wide awake to an emerging problem in the world and it’s one called resource scarcity. We’ve heard a lot about resource scarcity and mostly the reaction in the US is just to shrug their shoulders, we’ll figure out a way around it. Well, there really is not a way around certain kinds of scarcities.”

When asked where silver is headed in terms of price Leeb responded, “I could just look at it from a monetary point of view, forget about all of the industrial applications. The ratio of silver to gold in the world is about ten to one, maybe seven and a half to one, above and below ground if you look at reserves. So as a monetary metal you could make a case that silver should already be no more than a ten to one ratio with gold.”

When asked with the ten one ratio putting silver $150, is that an outrageous price for silver today Leeb responded, “No it isn’t, it’s not at all outrageous. Silver at $150 is in no way outrageous. I’m not counting the critical applications in the industrial and renewable areas.”

====

z

Don’t Expect the Value of Your Home To Rise Anytime Soon

Being in the market to buy... these articles make me want to wait for a lower price. One thing I notice is that even though prices are coming down, condo monthly dues are not! They will have to at some point or they will further drive away buyers.

========

Don’t Expect the Value of Your Home To Rise Anytime Soon

http://www.shtfplan.com/forecasting/dont-expect-the-value-of-your-home-to-rise-anytime-soon_05252011

Bad news for homeowners and real estate investors who were expecting a recovery real estate.

Despite the trillions of dollars pumped into the economy to ‘stabilize’ prices at pre-crash bubble highs, nature continues to force a shift towards equilibrium in the real estate market:

The ailing housing market remains hampered by the backlog of distressed properties, which is growing larger as banks repossess more homes than they sell.

Banks now hold more than 872,000 homes, nearly twice as many as in 2007, the New York Times reports, citing data from RealtyTrac. In regions like Atlanta and Minneapolis, banks are seizing more homes than they’re selling, suggesting that their staffs are overwhelmed by the volume of foreclosures, the NYT notes.

…

As of January, the shadow inventory constituted a nine-month supply of properties, according to a March report from data-provider CoreLogic.

The fall in prices even appears to be accelerating, as home values fell 3 percent in the first three months of this year, for the biggest quarterly drop since 2008, according to a report from data-provider Zillow. Home values will continue falling through the year, and likely won’t stabilize until 2012, Zillow chief economist Stan Humphries said in a statement earlier this month.

===

z

========

Don’t Expect the Value of Your Home To Rise Anytime Soon

http://www.shtfplan.com/forecasting/dont-expect-the-value-of-your-home-to-rise-anytime-soon_05252011

Bad news for homeowners and real estate investors who were expecting a recovery real estate.

Despite the trillions of dollars pumped into the economy to ‘stabilize’ prices at pre-crash bubble highs, nature continues to force a shift towards equilibrium in the real estate market:

The ailing housing market remains hampered by the backlog of distressed properties, which is growing larger as banks repossess more homes than they sell.

Banks now hold more than 872,000 homes, nearly twice as many as in 2007, the New York Times reports, citing data from RealtyTrac. In regions like Atlanta and Minneapolis, banks are seizing more homes than they’re selling, suggesting that their staffs are overwhelmed by the volume of foreclosures, the NYT notes.

…

As of January, the shadow inventory constituted a nine-month supply of properties, according to a March report from data-provider CoreLogic.

The fall in prices even appears to be accelerating, as home values fell 3 percent in the first three months of this year, for the biggest quarterly drop since 2008, according to a report from data-provider Zillow. Home values will continue falling through the year, and likely won’t stabilize until 2012, Zillow chief economist Stan Humphries said in a statement earlier this month.

===

z

Green Shoots, Exit Strategy, No QE3, Silver

Basically all this article says is that everything put out by the FedRes is a complete lie. He goes on to say that QE3 must happend, and they talks a little about gold and silver. I will put up a chart and quote on silver from the article.

Reading this makes me feel better on silver and makes me not want to sell a chunk at $40 like I had planned. Oh well, I'll just play it by ear.

Quote from the article, "Gold will not stop until it surpasses at least $5000 to $7000 in price. Silver will not stop until it surpasses at least $150 to $200 in price. Such forecasts invite mockery, but in two years they will seem prescient."

=======

Green Shoots, Exit Strategy, No QE3

http://silverbearcafe.com/private/05.11/shoots.html

The beauty of the silver decline is that when it reverses, there is no technical resistance of significance back to the $50 level. However, due to the shock effect, the climb will be slower than a sudden technical mirror image reversal. The precious metals investors should hope for a slow steady relentless painful nasty stubborn awesome devastating rise in price that doles out excruciating pain to the cartel, permits once again for the less enlightened doubters to cover their wrong short positions in a chronic manner. The story in the Silver chart has four weeks and four different stories. The first week of May had the powerful decline, the result of hitting the Hunt nominal target, Soros putting out his deceptive story of selling that which he called a bubble for a full year, the COMEX raising the margin requirement five times in quick succession, the USFed putting out its deceptive story about ending debt monetization and maybe hiking rates (gotta be dumb as a post to believe), the USEconomy demanding less in commodities. The second week showed a strong clear Doji Star, which epitomizes a move to stability. The Silver price found its footing and stood still, encouraging many investors to re-enter the market. The third week was less clear except to technical chart readers. It featured a strong clear Bull Hammer identified by an open and close at the high for the week, with price movement lower during the week. The hint was given on Monday of this week for a rebound. The US$ DX index was rising a little, as the Euro currency was sliding lower, like over 100 basis points for the day. Gold & Silver ignored it. Gold rose a little, while Silver was even at $35. Today, Silver is pushing $38 per ounce, and Gold is rising too. No resistance ahead!!

====

z

Reading this makes me feel better on silver and makes me not want to sell a chunk at $40 like I had planned. Oh well, I'll just play it by ear.

Quote from the article, "Gold will not stop until it surpasses at least $5000 to $7000 in price. Silver will not stop until it surpasses at least $150 to $200 in price. Such forecasts invite mockery, but in two years they will seem prescient."

=======

Green Shoots, Exit Strategy, No QE3

http://silverbearcafe.com/private/05.11/shoots.html

The beauty of the silver decline is that when it reverses, there is no technical resistance of significance back to the $50 level. However, due to the shock effect, the climb will be slower than a sudden technical mirror image reversal. The precious metals investors should hope for a slow steady relentless painful nasty stubborn awesome devastating rise in price that doles out excruciating pain to the cartel, permits once again for the less enlightened doubters to cover their wrong short positions in a chronic manner. The story in the Silver chart has four weeks and four different stories. The first week of May had the powerful decline, the result of hitting the Hunt nominal target, Soros putting out his deceptive story of selling that which he called a bubble for a full year, the COMEX raising the margin requirement five times in quick succession, the USFed putting out its deceptive story about ending debt monetization and maybe hiking rates (gotta be dumb as a post to believe), the USEconomy demanding less in commodities. The second week showed a strong clear Doji Star, which epitomizes a move to stability. The Silver price found its footing and stood still, encouraging many investors to re-enter the market. The third week was less clear except to technical chart readers. It featured a strong clear Bull Hammer identified by an open and close at the high for the week, with price movement lower during the week. The hint was given on Monday of this week for a rebound. The US$ DX index was rising a little, as the Euro currency was sliding lower, like over 100 basis points for the day. Gold & Silver ignored it. Gold rose a little, while Silver was even at $35. Today, Silver is pushing $38 per ounce, and Gold is rising too. No resistance ahead!!

====

z

RealtyTrac reports nearly one-third of home sales are distressed

Old news to some...

===

RealtyTrac reports nearly one-third of home sales are distressed

http://www.housingwire.com/2011/05/26/realtytrac-reports-nearly-one-third-of-home-sales-are-distressed

Sales of bank-owned homes and properties in some stage of foreclosure accounted for 28% of all U.S. residential sales in quarter one, up from 27% in the fourth quarter, RealtyTrac said Thursday in its 1Q 2011 survey.

The foreclosure data firm added that the average sales price of properties in foreclosure fell 1.89%, hitting $168,321 during the same period.

The average sales price for properties in foreclosure also fell approximately 27% below prime properties, the report said.

During the quarter, third-parties acquired 158,434 U.S. bank-owned homes and properties in some stage of the foreclosure process, down 16% from the revised fourth-quarter figures and 36% from year-ago levels.

====

z

===

RealtyTrac reports nearly one-third of home sales are distressed

http://www.housingwire.com/2011/05/26/realtytrac-reports-nearly-one-third-of-home-sales-are-distressed

Sales of bank-owned homes and properties in some stage of foreclosure accounted for 28% of all U.S. residential sales in quarter one, up from 27% in the fourth quarter, RealtyTrac said Thursday in its 1Q 2011 survey.

The foreclosure data firm added that the average sales price of properties in foreclosure fell 1.89%, hitting $168,321 during the same period.

The average sales price for properties in foreclosure also fell approximately 27% below prime properties, the report said.

During the quarter, third-parties acquired 158,434 U.S. bank-owned homes and properties in some stage of the foreclosure process, down 16% from the revised fourth-quarter figures and 36% from year-ago levels.

====

z

Wednesday, May 25, 2011

Medical Doctors may be Hazardous to your Health

Slowly we are waking up to the fact that medical doctors are influenced by big pharma, hence whether they know it or not, they are not necessarily in your health's best interest.

====

Medical Doctors may be Hazardous to your Health

http://thewatchers.adorraeli.com/2011/05/25/two-new-studies-warn-medical-doctors-may-be-hazardous-to-your-health/

Today’s doctors-in-training are learning how to think critically and clearly about the need for — and potential dangers of — any drugs they prescribe. And surgeons only operate if they are physically and mentally able to make sure they will not be putting their patient in any danger, right? Unfortunately, two new papers show that those assumptions are wrong. In fact, they reveal critical reasons why mainstream medicine can be a danger to your health and even threaten your life.

Bottom line: med students are being taught through a hidden curriculum devised and carried out by Big Pharma (and allowed by medical schools) to push the prescribing of their drugs. Meanwhile, countless surgeons are operating and sometimes harming patients because they are impaired by fatigue and lack of sleep.

Here are the facts. Medical students in the United States are being bombarded with the pro-drug propaganda of pharmaceutical companies– and the students are exposed to this throughout their education, even in the years before they have clinical experience treating patients. According to research led by Kirsten Austad and Aaron S. Kesselheim from Harvard Medical School just published inPLoS Medicine, it turns out the drug giants have created what the Harvard researchers have dubbed a highly influentialhidden curriculum

that pushes doctors-in-training into accepting and promoting Big Pharma’s prescription drugs and other therapies.

The enormous and ongoing contact with drug companies is associated with medical professionals developing positive attitudes about the marketing of prescription medications. Moreover, the med students are not developing any healthy skepticism about potential negative implications of the drug pushing techniques — or the drugs themselves.

=====

z

====

Medical Doctors may be Hazardous to your Health

http://thewatchers.adorraeli.com/2011/05/25/two-new-studies-warn-medical-doctors-may-be-hazardous-to-your-health/

Today’s doctors-in-training are learning how to think critically and clearly about the need for — and potential dangers of — any drugs they prescribe. And surgeons only operate if they are physically and mentally able to make sure they will not be putting their patient in any danger, right? Unfortunately, two new papers show that those assumptions are wrong. In fact, they reveal critical reasons why mainstream medicine can be a danger to your health and even threaten your life.

Bottom line: med students are being taught through a hidden curriculum devised and carried out by Big Pharma (and allowed by medical schools) to push the prescribing of their drugs. Meanwhile, countless surgeons are operating and sometimes harming patients because they are impaired by fatigue and lack of sleep.

Here are the facts. Medical students in the United States are being bombarded with the pro-drug propaganda of pharmaceutical companies– and the students are exposed to this throughout their education, even in the years before they have clinical experience treating patients. According to research led by Kirsten Austad and Aaron S. Kesselheim from Harvard Medical School just published inPLoS Medicine, it turns out the drug giants have created what the Harvard researchers have dubbed a highly influentialhidden curriculum

that pushes doctors-in-training into accepting and promoting Big Pharma’s prescription drugs and other therapies.

The enormous and ongoing contact with drug companies is associated with medical professionals developing positive attitudes about the marketing of prescription medications. Moreover, the med students are not developing any healthy skepticism about potential negative implications of the drug pushing techniques — or the drugs themselves.

=====

z

Inflation SHOCK: Food prices surging at highest rate in 21 years

There is no inflation. Why on earth would you want to protect your wealth in an inflation protected zero counter party risk asset like silver and gold?

=====

Inflation SHOCK: Food prices surging at highest rate in 21 years

http://www.thedailycrux.com/content/7768/Agriculture/eml

U.S. food-price inflation may top the government's forecast as higher crop, meat, dairy and energy costs lead companies including Nestle SA, McDonald's Corp. (MCD) and Whole Foods Market Inc. (WFMI) to boost prices.

Retail-food prices will jump more than the U.S. Department of Agriculture's estimate of 3 percent to 4 percent this year, said Chad E. Hart, an economist at Iowa State University in Ames. Companies will pass along more of their higher costs through year-end, said Bill Lapp, a former ConAgra Foods Inc. chief economist. The USDA will update its forecast today.

Groceries and restaurant meals rose 2.4 percent in the four months through April, the most to start a year since 1990, government data show. During the period, rice, wheat and milk futures touched the highest levels since 2008, and retail beef reached a record. Yesterday, J.M. Smucker Co. announced an 11 percent price increase for Folgers coffee, the best-selling U.S. brand, after the cost of beans almost doubled in a year.

"It's going to be a tough year" for U.S. shoppers, said Lapp, who is president of Advanced Economic Solutions, an agriculture consultant in Omaha, Nebraska. "You're looking at an economy where a lot of consumers are under some serious pressure from food and fuel costs."

Even after a drop in commodities this month, seven of eight tracked by the Standard & Poor's GSCI Agriculture Index are higher than a year earlier as adverse weather damages crops, rising demand erodes inventories and a weak dollar boosts demand for U.S. exports. Corn futures are up 98 percent, wheat gained 67 percent, raw sugar advanced 44 percent, and rice jumped 25 percent.

======

z

=====

Inflation SHOCK: Food prices surging at highest rate in 21 years

http://www.thedailycrux.com/content/7768/Agriculture/eml

U.S. food-price inflation may top the government's forecast as higher crop, meat, dairy and energy costs lead companies including Nestle SA, McDonald's Corp. (MCD) and Whole Foods Market Inc. (WFMI) to boost prices.

Retail-food prices will jump more than the U.S. Department of Agriculture's estimate of 3 percent to 4 percent this year, said Chad E. Hart, an economist at Iowa State University in Ames. Companies will pass along more of their higher costs through year-end, said Bill Lapp, a former ConAgra Foods Inc. chief economist. The USDA will update its forecast today.

Groceries and restaurant meals rose 2.4 percent in the four months through April, the most to start a year since 1990, government data show. During the period, rice, wheat and milk futures touched the highest levels since 2008, and retail beef reached a record. Yesterday, J.M. Smucker Co. announced an 11 percent price increase for Folgers coffee, the best-selling U.S. brand, after the cost of beans almost doubled in a year.

"It's going to be a tough year" for U.S. shoppers, said Lapp, who is president of Advanced Economic Solutions, an agriculture consultant in Omaha, Nebraska. "You're looking at an economy where a lot of consumers are under some serious pressure from food and fuel costs."

Even after a drop in commodities this month, seven of eight tracked by the Standard & Poor's GSCI Agriculture Index are higher than a year earlier as adverse weather damages crops, rising demand erodes inventories and a weak dollar boosts demand for U.S. exports. Corn futures are up 98 percent, wheat gained 67 percent, raw sugar advanced 44 percent, and rice jumped 25 percent.

======

z

Trade Update on Silver

Full Disclosure, I sold some PSLV at these levels. Since I use margin, I am now only 130% long PSLV. I took some off the table and plan to take a little more off if silver hits $40. The reason is that just in case silver decides to retest $33 or $35, I'd like to have some dry powder available to buy more.

My new phyzz arrives tomorrow. Trade paper silver. Accumulate physical silver.

z

My new phyzz arrives tomorrow. Trade paper silver. Accumulate physical silver.

z

Tuesday, May 24, 2011

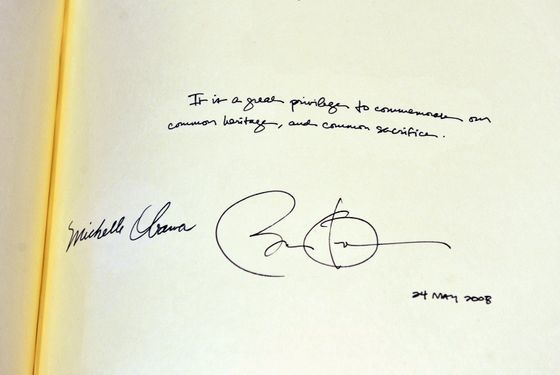

LOL at 0bama

Heh! Granted I get the date wrong sometimes too, but usually it is in January and the year I put down is the previous one. This should file under Tuesday Funny.

============

President Obama Has No Idea What Year It Is

http://nymag.com/daily/intel/2011/05/president_obama_has_no_idea_wh.html

This is how President Obama signed the guestbook at Westminster Abbey earlier today, where he got a tour from the Very Reverend Dr. John Hall and laid a wreath on the Grave of the Unknown Warrior.

It is a great privilege to commemorate our common heritage, and common sacrifice.

Barack Obama

24 May 2008

It was really nice until he got the date wrong by three years. Granted, 2008 was a great year for him, and we might try to live it for as long as possible, too, if we were him. Also, though, he may have had a stroke.

Update: For those who find the European-style date suspicious, the Telegraph reports that a "Westminster Abbey spokeswoman confirmed it was the president who had written the wrong date."

===

z

============

President Obama Has No Idea What Year It Is

http://nymag.com/daily/intel/2011/05/president_obama_has_no_idea_wh.html

This is how President Obama signed the guestbook at Westminster Abbey earlier today, where he got a tour from the Very Reverend Dr. John Hall and laid a wreath on the Grave of the Unknown Warrior.

It is a great privilege to commemorate our common heritage, and common sacrifice.

Barack Obama

24 May 2008

It was really nice until he got the date wrong by three years. Granted, 2008 was a great year for him, and we might try to live it for as long as possible, too, if we were him. Also, though, he may have had a stroke.

Update: For those who find the European-style date suspicious, the Telegraph reports that a "Westminster Abbey spokeswoman confirmed it was the president who had written the wrong date."

===

z

Embry - Silver Market Extraordinarily Tight, Look for $125

No matter how you slice it, everyone that knows what they are talking about thinks that silver will be over $100 in less than 2 years. That's nearly triple from here at the lowest. Most expect in the $120-140, which is quadruple from here. These are low ball estimates for the end of 2012. If you combine this article, with the one posted directly before it with gold at $5000 that puts silver at nearly $300 in a few years, or 8-fold from where we are today at $36.

Of course it could go higher. Buy the phyzz. As much as you possible can. Buy popcorn. Watch. Retire early.

=====

Embry - Silver Market Extraordinarily Tight, Look for $125

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/24_Embry_-_Silver_Market_Extraordinarily_Tight,_Look_for_$125.html

When asked if there was still tightness in the silver market Embry replied, “As far as what we look at, my partner Eric Sprott, he thinks the market is extraordinarily tight. I think one thing people are underestimating is the investment demand. This is being triggered by the high gold price which is driving the little guy into silver for the simple reason that he can’t handle how much it costs to get an exposure in gold, so he buys silver.

So I think this will be an ongoing phenomena and when you put that together with the strong industrial demand, the two together will drive silver much higher. I think the optimists that are talking about the gold/silver ratio declining to historical lows of 10 to 15 times could well be right, and given where I think gold is going, I mean that has an enormous upside potential for silver.

...Well let’s say gold goes to $2,500 which I don’t think is an outrageous statement in the face of what is going on, and the gold silver ratio falls to 20 to 1, well that puts silver at $125...People that were top-calling in silver and gloating when it got taken to the cleaners, I don’t really think they really understand the dynamics of the market.”

====

z

Of course it could go higher. Buy the phyzz. As much as you possible can. Buy popcorn. Watch. Retire early.

=====

Embry - Silver Market Extraordinarily Tight, Look for $125

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/24_Embry_-_Silver_Market_Extraordinarily_Tight,_Look_for_$125.html

When asked if there was still tightness in the silver market Embry replied, “As far as what we look at, my partner Eric Sprott, he thinks the market is extraordinarily tight. I think one thing people are underestimating is the investment demand. This is being triggered by the high gold price which is driving the little guy into silver for the simple reason that he can’t handle how much it costs to get an exposure in gold, so he buys silver.

So I think this will be an ongoing phenomena and when you put that together with the strong industrial demand, the two together will drive silver much higher. I think the optimists that are talking about the gold/silver ratio declining to historical lows of 10 to 15 times could well be right, and given where I think gold is going, I mean that has an enormous upside potential for silver.

...Well let’s say gold goes to $2,500 which I don’t think is an outrageous statement in the face of what is going on, and the gold silver ratio falls to 20 to 1, well that puts silver at $125...People that were top-calling in silver and gloating when it got taken to the cleaners, I don’t really think they really understand the dynamics of the market.”

====

z

Russell - Expect $5,000 as US Has to Back Currency With Gold

Russell - Expect $5,000 as US Has to Back Currency With Gold

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/24_Russell_-_Expect_$5,000_as_US_Has_to_Back_Currency_With_Gold.html

I think the gold action goes along with the above scenario. Why take profits or sell your gold, when the real move in gold is slated for 2012 and beyond?

Why is China so intent on accumulating gold? My thinking is that China is preparing its renminbi to replace the US dollar as the world's reserve currency. To become the new world power, China needs two items: (1) A military second to none. (2) The world's most trusted and wanted currency.

(1) China is now on an all-out campaign to build up its military. (2) China wants the renminbi to backed with a huge percentage of gold, thereby making the renminbi the world's best and most trusted currency.

To compete, I believe that somewhere head the US will have to back its current irredeemable fiat currency with gold. In order to do that, the US will have to boost the price of its huge gold hoard to a level where the dollar may be backed anywhere from 50% to 100% with gold. That could mean unilaterally raising the price of gold to maybe $5000 and ounce or more...I thought that gold, closing higher, in the face of the stronger dollar, was significant. Gold appears to be advancing against almost all fiat currencies (is this a preview of the future?).

=====

z

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2011/5/24_Russell_-_Expect_$5,000_as_US_Has_to_Back_Currency_With_Gold.html

I think the gold action goes along with the above scenario. Why take profits or sell your gold, when the real move in gold is slated for 2012 and beyond?

Why is China so intent on accumulating gold? My thinking is that China is preparing its renminbi to replace the US dollar as the world's reserve currency. To become the new world power, China needs two items: (1) A military second to none. (2) The world's most trusted and wanted currency.

(1) China is now on an all-out campaign to build up its military. (2) China wants the renminbi to backed with a huge percentage of gold, thereby making the renminbi the world's best and most trusted currency.

To compete, I believe that somewhere head the US will have to back its current irredeemable fiat currency with gold. In order to do that, the US will have to boost the price of its huge gold hoard to a level where the dollar may be backed anywhere from 50% to 100% with gold. That could mean unilaterally raising the price of gold to maybe $5000 and ounce or more...I thought that gold, closing higher, in the face of the stronger dollar, was significant. Gold appears to be advancing against almost all fiat currencies (is this a preview of the future?).

=====

z

Bob Chapman Tyranny, Silver And Your 401K

Bob Chapman Tyranny, Silver And Your 401K

Bob Chapman says the Hong Kong Mercantile Exchange is going to sell silver in two to three months, right about the July CRIMEX delivery contract.

Bob says NOT TO TRADE THE SILVER MARKET. ONLY BUY PHYSICAL SILVER. Go long and stay long.

Get out of your 401k and IRA if you can’t get out borrow against it.

====

z

Bob Chapman says the Hong Kong Mercantile Exchange is going to sell silver in two to three months, right about the July CRIMEX delivery contract.

Bob says NOT TO TRADE THE SILVER MARKET. ONLY BUY PHYSICAL SILVER. Go long and stay long.

Get out of your 401k and IRA if you can’t get out borrow against it.

====

z

A Historical Case for $960 Silver

I can only dream...

====

http://dont-tread-on.me/a-historical-case-for-960-silver/

A Historical Case for $960 Silver

By Silver Shield, on May 5th, 2011

During the height of the Roman Empire that average days pay for a soldier and laborer was on silver Denarius. This Denarius was 1/10th of an ounce of silver, similar to our silver dimes of yesteryear. What I find amazing is the implied value of this coin into our modern lives.

This dime of the Roman Empire was the average wage of the average worker. It paid for all of the living expenses of a man and his family; food, shelter, clothes, taxes and maybe a little fun from time to time. How would we begin to relate the value of that Roman dime to where we are today. First think about the kind of work a Roman soldier or a field worker would have to do to get that Denarius. Most likely the Roman soldier would be enduring terrible conditions or fighting in hand to hand combat. The average laborer would be working 12 hour days using rudimentary tools doing arduous tasks to eek out an existence.

The average American Empire laborer or soldier probably makes minimum wage of about $8 an hour. If we multiplied $8 times the 12 hours the Roman laborers must have worked that would make the implied value of the silver Denarius about $96. If the Denarius is 1/10th of an ounce of silver, then the implied value of an ounce of silver is $960. Let’s think about it another way, Judas sold out Jesus Christ for 30 Sheckles which is about 15 ounces of silver. Would you condemn your friend, much less the Messiah to death for 15 x $38= $570? What about 15 x $960= $14,400? That seems to be about the same cost I hear in those murder for hire plots…

This is just one of the many ways for you to see through the paper silver propaganda. For a more complete picture, read the Silver Bullet and the Silver Shield. http://dont-tread-on.me/the-silver-bullet-and-the-silver-shield/ . Why you are aware of the once in human existence opportunities of investing in physical silver, then it makes it easier to create generational wealth. Buy right, and sit tight.

======

z

====

http://dont-tread-on.me/a-historical-case-for-960-silver/

A Historical Case for $960 Silver

By Silver Shield, on May 5th, 2011

During the height of the Roman Empire that average days pay for a soldier and laborer was on silver Denarius. This Denarius was 1/10th of an ounce of silver, similar to our silver dimes of yesteryear. What I find amazing is the implied value of this coin into our modern lives.

This dime of the Roman Empire was the average wage of the average worker. It paid for all of the living expenses of a man and his family; food, shelter, clothes, taxes and maybe a little fun from time to time. How would we begin to relate the value of that Roman dime to where we are today. First think about the kind of work a Roman soldier or a field worker would have to do to get that Denarius. Most likely the Roman soldier would be enduring terrible conditions or fighting in hand to hand combat. The average laborer would be working 12 hour days using rudimentary tools doing arduous tasks to eek out an existence.

The average American Empire laborer or soldier probably makes minimum wage of about $8 an hour. If we multiplied $8 times the 12 hours the Roman laborers must have worked that would make the implied value of the silver Denarius about $96. If the Denarius is 1/10th of an ounce of silver, then the implied value of an ounce of silver is $960. Let’s think about it another way, Judas sold out Jesus Christ for 30 Sheckles which is about 15 ounces of silver. Would you condemn your friend, much less the Messiah to death for 15 x $38= $570? What about 15 x $960= $14,400? That seems to be about the same cost I hear in those murder for hire plots…

This is just one of the many ways for you to see through the paper silver propaganda. For a more complete picture, read the Silver Bullet and the Silver Shield. http://dont-tread-on.me/the-silver-bullet-and-the-silver-shield/ . Why you are aware of the once in human existence opportunities of investing in physical silver, then it makes it easier to create generational wealth. Buy right, and sit tight.

======

z

Alex Jones’ Audio Blog: Owner’s Manual on Reality

Alex Jones’ Audio Blog: Owner’s Manual on Reality

======

z

======

z

Silver Shield

Silver bullets and silver shields will protect you from what is coming. Prepare accordingly.

===============

Silver Shield 2 parts

http://silverbearcafe.com/private/05.11/sivershield.html

and

=====

z

===============

Silver Shield 2 parts

http://silverbearcafe.com/private/05.11/sivershield.html

and

=====

z

Nowhere to Go: 85% of College Graduates Will Return Home Jobless

Fortunately, I am not one of those people. However, by choice I may be choosing a career not directly related to my 4 collage degrees. Heh, LOL.

====

Nowhere to Go: 85% of College Graduates Will Return Home Jobless

http://www.shtfplan.com/headline-news/nowhere-to-go-85-of-college-graduates-will-return-home-jobless_05242011

That’s 1.7 million graduates who are going to have their dreams and delusions crushed in coming weeks and months.

How long will we continue to pretend that America’s economy is returning to normal? President Obama and mainstream economists can argue all they want about us having avoided a depression, but that’s far from the experience being had by millions on Main Street.

The real unemployment rate in America is north of 20% – that’s one in five Americans who can’t find work. College graduates, who have been made to believe throughout their lives that a college degree is all they will need to find a ‘good’ job are getting a rude awakening. For any meaningful position that becomes available, there are thousands of applicants. Heck, when McDonald’s held a job fair recently, there were hundreds of thousands of applicants for positions paying minimum wage. This should tell you something.

The government would have us believe that economic growth as measured by GDP is positive. This is yet another falsehood, as a large portion of those growth numbers are based on price inflation. Without jobs there can be no actual growth, there can be no increase in consumption, and there can be no recovery.

The most alarming aspect for those who subscribe to the view that things aren’t exactly as they may seem by mainstream accounts is that the negative feedback loop will only accelerate. As more people lose jobs or can’t find jobs, less money is spent on consumption, leading to even more job losses.

=====

z

====

Nowhere to Go: 85% of College Graduates Will Return Home Jobless

http://www.shtfplan.com/headline-news/nowhere-to-go-85-of-college-graduates-will-return-home-jobless_05242011

That’s 1.7 million graduates who are going to have their dreams and delusions crushed in coming weeks and months.

How long will we continue to pretend that America’s economy is returning to normal? President Obama and mainstream economists can argue all they want about us having avoided a depression, but that’s far from the experience being had by millions on Main Street.

The real unemployment rate in America is north of 20% – that’s one in five Americans who can’t find work. College graduates, who have been made to believe throughout their lives that a college degree is all they will need to find a ‘good’ job are getting a rude awakening. For any meaningful position that becomes available, there are thousands of applicants. Heck, when McDonald’s held a job fair recently, there were hundreds of thousands of applicants for positions paying minimum wage. This should tell you something.

The government would have us believe that economic growth as measured by GDP is positive. This is yet another falsehood, as a large portion of those growth numbers are based on price inflation. Without jobs there can be no actual growth, there can be no increase in consumption, and there can be no recovery.

The most alarming aspect for those who subscribe to the view that things aren’t exactly as they may seem by mainstream accounts is that the negative feedback loop will only accelerate. As more people lose jobs or can’t find jobs, less money is spent on consumption, leading to even more job losses.

=====

z

Gold currency : Many US states to follow Utah

Gold currency : Many US states to follow Utah

SALT LAKE CITY (Commodity Online) : Nearly a month after Utah became the first state in the United States to officially recognize gold and silver coins as legal currency, many other states are also on the track to legalize gold and silver legal tender.

Earlier this month, Minnesota took a step closer to joining Utah in making gold and silver legal tender. A Republican lawmaker there introduced a bill that sets up a special committee to explore the option. North Carolina, Idaho and at least nine other states also have similar bills drafted.

http://www.commodityonline.com/news/Gold-currency--Many-US-states-to-follow-Utah-39282-3-1.html

===

z

SALT LAKE CITY (Commodity Online) : Nearly a month after Utah became the first state in the United States to officially recognize gold and silver coins as legal currency, many other states are also on the track to legalize gold and silver legal tender.

Earlier this month, Minnesota took a step closer to joining Utah in making gold and silver legal tender. A Republican lawmaker there introduced a bill that sets up a special committee to explore the option. North Carolina, Idaho and at least nine other states also have similar bills drafted.

http://www.commodityonline.com/news/Gold-currency--Many-US-states-to-follow-Utah-39282-3-1.html

===

z

Monday, May 23, 2011

Fed's Bullard sees rates on hold after QE2

Hah knew it! This is the first sign that there will be QE3, although it probably won't be called that. They can't raise rates because there is no recovery and doing so would completely wipe out 50% of the stock market. What does this mean. Higher gold and silver. Keep buying as much physical as you can.

Notice that the ratio has gone back to 44, as gold has climbed, while silver remains flat. The floor for silver at $35 is getting stronger with each passing day. Every time it goes below it bounces back up like a beach ball pushed under water. Every paycheck right now I am accumulating both phyzz and PSLV.

Hi Ho Silver.

====

Fed's Bullard sees rates on hold after QE2

http://www.marketwatch.com/story/feds-bullard-sees-rates-on-hold-after-qe2-2011-05-23?link=MW_story_latest_news

SYDNEY (MarketWatch) -- The Federal Reserve is likely to keep policy rates on hold after QE2 to provide more time to evaluate the strength of the U.S. economy, a top official said late Monday. Federal Reserve Bank of St. Louis President James Bullard said the central bank is likely to keep its commitment of near-zero interest rates for an "extended period," after the expected June expiry of its asset purchases. "Past behavior of the Federal Open Market Committee indicates that the Committee sometimes puts policy on hold," he said, noting that a pause "gives the Committee more time to assess economic conditions." Speaking in Missouri, the St. Louis Fed president repeated calls for the central bank to abandon its use of core inflation, in favor of a wider measure. Bullard also warned that while commodity prices cannot continue to increase forever, "it is at least a reasonable hypothesis that global demand for energy will outstrip increased supply over the coming decades."

====

z

Notice that the ratio has gone back to 44, as gold has climbed, while silver remains flat. The floor for silver at $35 is getting stronger with each passing day. Every time it goes below it bounces back up like a beach ball pushed under water. Every paycheck right now I am accumulating both phyzz and PSLV.

Hi Ho Silver.

====

Fed's Bullard sees rates on hold after QE2

http://www.marketwatch.com/story/feds-bullard-sees-rates-on-hold-after-qe2-2011-05-23?link=MW_story_latest_news

SYDNEY (MarketWatch) -- The Federal Reserve is likely to keep policy rates on hold after QE2 to provide more time to evaluate the strength of the U.S. economy, a top official said late Monday. Federal Reserve Bank of St. Louis President James Bullard said the central bank is likely to keep its commitment of near-zero interest rates for an "extended period," after the expected June expiry of its asset purchases. "Past behavior of the Federal Open Market Committee indicates that the Committee sometimes puts policy on hold," he said, noting that a pause "gives the Committee more time to assess economic conditions." Speaking in Missouri, the St. Louis Fed president repeated calls for the central bank to abandon its use of core inflation, in favor of a wider measure. Bullard also warned that while commodity prices cannot continue to increase forever, "it is at least a reasonable hypothesis that global demand for energy will outstrip increased supply over the coming decades."

====

z

Calif. Must Release 37,000 Inmates

Time to get out of Cali I guess...

=====

Supreme Court Rules California Must Free Tens of Thousands of Inmates

http://www.foxnews.com/politics/2011/05/23/supreme-court-rules-california-free-tens-thousands-inmates/

A sharply divided Supreme Court Monday affirmed a controversial prisoner reduction plan forced on California prison administrators that requires the state to reduce its inmate population by tens-of-thousands to ease overcrowding.

The 5-4 decision authored by Justice Anthony Kennedy, a California native, is a wholesale acceptance of a ruling by a special three-judge panel tasked with resolving chronic overcrowding in the state's penal system. The February 2009 decision orders California to reduce its prison population that has at times run nearly double its capacity. Approximately 37,000 to 46,000 inmates will have to be released in order for the state to comply with the ruling.

====

z

=====

Supreme Court Rules California Must Free Tens of Thousands of Inmates

http://www.foxnews.com/politics/2011/05/23/supreme-court-rules-california-free-tens-thousands-inmates/

A sharply divided Supreme Court Monday affirmed a controversial prisoner reduction plan forced on California prison administrators that requires the state to reduce its inmate population by tens-of-thousands to ease overcrowding.

The 5-4 decision authored by Justice Anthony Kennedy, a California native, is a wholesale acceptance of a ruling by a special three-judge panel tasked with resolving chronic overcrowding in the state's penal system. The February 2009 decision orders California to reduce its prison population that has at times run nearly double its capacity. Approximately 37,000 to 46,000 inmates will have to be released in order for the state to comply with the ruling.

====

z

The War on Ron Paul

"The federal government we live with today no longer serves the interests of the American people, but serves the special interests of: corporate cronyism; militarism for profit influence and empire; centrally planned debt management, counterfeiting, fraud and currency debasement. "

- Couldn't say it any better myself.

====

The War on Ron Paul

http://www.infowars.com/the-war-on-ron-paul/

Susan Westfall

LewRockwell.com

May 23, 2011

Whether the media establishments want to admit it or not, and believe me they don’t, Ron Paul IS the ‘front runner’ for the republican primary. Despite voracious denials and vitriolic arguments from almost every quarter to the contrary, he is the only one with a chance of shutting out Obama for the presidency in 2012. He appeals to all sides of the aisle, and is attracting the much sought after independent swing vote almost as fast as he has the youth of the nation. The Internet is indisputably Ron Paul country as countless polls and google trends have repeatedly shown. The gradual change in political rhetoric flowing out of Washington, D.C. over the last 3 years reflects an explosion of interest in the freedom message he spreads so tirelessly. The continuous growth in popularity of talk and news shows focusing on freedom and the Constitution broadcasts loud and clear the rising prominence of issues he has brought to the debate. For anyone with any powers of discernment, it’s a no-brainer.

=====

z

- Couldn't say it any better myself.

====

The War on Ron Paul

http://www.infowars.com/the-war-on-ron-paul/

Susan Westfall

LewRockwell.com

May 23, 2011

Whether the media establishments want to admit it or not, and believe me they don’t, Ron Paul IS the ‘front runner’ for the republican primary. Despite voracious denials and vitriolic arguments from almost every quarter to the contrary, he is the only one with a chance of shutting out Obama for the presidency in 2012. He appeals to all sides of the aisle, and is attracting the much sought after independent swing vote almost as fast as he has the youth of the nation. The Internet is indisputably Ron Paul country as countless polls and google trends have repeatedly shown. The gradual change in political rhetoric flowing out of Washington, D.C. over the last 3 years reflects an explosion of interest in the freedom message he spreads so tirelessly. The continuous growth in popularity of talk and news shows focusing on freedom and the Constitution broadcasts loud and clear the rising prominence of issues he has brought to the debate. For anyone with any powers of discernment, it’s a no-brainer.

=====

z

How Long Will it Take If I Cash Out My 401K?

Food for thought.... I'd cash out and buy physical silver, gold, and platinum, but that's just me. Again look at the strength of gold today even in spite of the dollar gaining versus the euro. Gold and silver will probably go sideways for 1 more month, until an extension of stimulus is announced, then they will start their climb back up.

=====

How Long Will it Take If I Cash Out My 401K?

http://www.ehow.com/info_8343663_long-cash-out-401k.html

By Ciaran John, eHow Contributor updated May 03, 2011

When you cash out your 401k retirement account, your account custodian has to sell all of the securities held inside the account. Depending on how you arrange to have the funds disbursed, it can take several days before you actually receive your funds. Additionally, you may not receive the entire account balance due to the vesting schedule and taxation.

Selling Mutual Funds

Typically, 401k accounts contain mutual funds and the share price of a mutual fund depends on the value of the underlying stocks and bonds. Mutual fund shares are sold once daily after the stock market closes for the day. You must place your sell order before the market closes, which means you do not know how much your shares will sell for since the share price depends on the closing value of the stocks and bonds in the fund. Federal securities laws require buyers and traders of securities to transfer funds for purchase transactions within three business days. However, no rule exists that specifies how quickly a fund company must disburse funds that result from a sale although most companies do disburse your funds within a few days of the sale.

Vesting

Your employer's 401k plan has a vesting schedule that specifies when you assume control of matching 401k contributions made by your employer. Some 401k plans have rules in place that mean that your employer's contributions do not technically become yours until two or three years after the contribution date. If you sell your 401k before your employer's contributions are vested, then you only receive the money that you contributed to the account yourself and your account earnings.

Taxes

Contributions to 401k accounts are made on a pre-tax basis and when you make a withdrawal your employer has to withhold 20 percent of your disbursement to cover federal income tax. If you are below the age of 59 1/2 you also have to pay a 10 percent premature withdrawal penalty tax. Your employer does not automatically withhold this 10-percent penalty from your disbursement. Due to the 20-percent tax withholding, you do not receive the entire amount that you had in your account.

Method

Investment firms can use a variety of different means to disburse your 401k funds. Typically, when you cash in your 401k, the fund company mails out a check and it can take seven to 10 days for this check to arrive. Many firms give you the option of having your funds sent by a wire transfer. This usually costs between $10 and $30, but allows you to receive your money on the day after the sale occurs. Therefore, if your 401k custodian processes your sale quickly and wires you the money, you can take receipt of your money within two or three days of placing your trade.

====

z

=====

How Long Will it Take If I Cash Out My 401K?

http://www.ehow.com/info_8343663_long-cash-out-401k.html

By Ciaran John, eHow Contributor updated May 03, 2011

When you cash out your 401k retirement account, your account custodian has to sell all of the securities held inside the account. Depending on how you arrange to have the funds disbursed, it can take several days before you actually receive your funds. Additionally, you may not receive the entire account balance due to the vesting schedule and taxation.

Selling Mutual Funds

Typically, 401k accounts contain mutual funds and the share price of a mutual fund depends on the value of the underlying stocks and bonds. Mutual fund shares are sold once daily after the stock market closes for the day. You must place your sell order before the market closes, which means you do not know how much your shares will sell for since the share price depends on the closing value of the stocks and bonds in the fund. Federal securities laws require buyers and traders of securities to transfer funds for purchase transactions within three business days. However, no rule exists that specifies how quickly a fund company must disburse funds that result from a sale although most companies do disburse your funds within a few days of the sale.

Vesting

Your employer's 401k plan has a vesting schedule that specifies when you assume control of matching 401k contributions made by your employer. Some 401k plans have rules in place that mean that your employer's contributions do not technically become yours until two or three years after the contribution date. If you sell your 401k before your employer's contributions are vested, then you only receive the money that you contributed to the account yourself and your account earnings.

Taxes

Contributions to 401k accounts are made on a pre-tax basis and when you make a withdrawal your employer has to withhold 20 percent of your disbursement to cover federal income tax. If you are below the age of 59 1/2 you also have to pay a 10 percent premature withdrawal penalty tax. Your employer does not automatically withhold this 10-percent penalty from your disbursement. Due to the 20-percent tax withholding, you do not receive the entire amount that you had in your account.

Method

Investment firms can use a variety of different means to disburse your 401k funds. Typically, when you cash in your 401k, the fund company mails out a check and it can take seven to 10 days for this check to arrive. Many firms give you the option of having your funds sent by a wire transfer. This usually costs between $10 and $30, but allows you to receive your money on the day after the sale occurs. Therefore, if your 401k custodian processes your sale quickly and wires you the money, you can take receipt of your money within two or three days of placing your trade.

====

z

Sunday, May 22, 2011

How the City of London Controls World Power ...

The more you know...

=====

How the City of London Controls World Power ...

http://silverbearcafe.com/private/05.11/cityoflondon.html

What happened in the heart of Greater London in 1694 under the direction of King William III of the House of Orange? Well, that would be when King William privatized the Bank of England, established the City of London, and turned control of England's money over to an elite group of international bankers.

Like Vatican City, London City (not to be confused with Greater London) is a privately owned corporation operating under its own flag, with its own constitution and free from the legal constraints that govern the rest of us. And it was King William III in 1694 who paved the way for a private cartel of international bankers (money elite) to embark on a plan of implementing world governance, albeit secretly (that is until now, thanks to the Internet Reformation).

Find out more about how the power elite has built their base of global infrastructure for controlling world economies, media, politics and religion. Watch this telling video presentation.

==============

z

=====

How the City of London Controls World Power ...

http://silverbearcafe.com/private/05.11/cityoflondon.html

What happened in the heart of Greater London in 1694 under the direction of King William III of the House of Orange? Well, that would be when King William privatized the Bank of England, established the City of London, and turned control of England's money over to an elite group of international bankers.

Like Vatican City, London City (not to be confused with Greater London) is a privately owned corporation operating under its own flag, with its own constitution and free from the legal constraints that govern the rest of us. And it was King William III in 1694 who paved the way for a private cartel of international bankers (money elite) to embark on a plan of implementing world governance, albeit secretly (that is until now, thanks to the Internet Reformation).

Find out more about how the power elite has built their base of global infrastructure for controlling world economies, media, politics and religion. Watch this telling video presentation.

==============

z

Friday, May 20, 2011

Government Orders YouTube To Censor Protest Videos

Government Orders YouTube To Censor Protest Videos

http://www.infowars.com/government-orders-you-tube-to-censor-protest-videos/

In a frightening example of how the state is tightening its grip around the free Internet, it has emerged that You Tube is complying with thousands of requests from governments to censor and remove videos that show protests and other examples of citizens simply asserting their rights, while also deleting search terms by government mandate.

The latest example is You Tube’s compliance with a request from the British government to censor footage of the British Constitution Group’s Lawful Rebellion protest, during which they attempted to civilly arrest Judge Michael Peake at Birkenhead county court.